Indian Rupee to Dollar Value: Today’s Rate & Historical Context

This rate shows how strong or weak our rupee is compared to the US dollar.

Right now, the value keeps changing every day because of the economy, global markets, and government policies. Think of it like the price of something in a shop – demand and supply keep shifting, so the price moves up and down.

This guide will help you understand:

Today’s rupee-to-dollar rate

Why the rate changes

How the rate has moved from 1947 till now

What this means for you – travel, buying stuff, and India’s economy

FAQs that clear up the confusion

1 USD = 89.96 INR

Why the INR to USD Rate Keeps Changing: Key Factors Explained

Let’s keep it simple. The rupee moves because of economy ka mood — India’s and the world’s. Here’s what actually pushes it:

1. Economic Factors Inside India

High inflation = weak rupee

Good GDP growth = stronger rupee

High foreign investment = more demand for rupee

Big trade deficit = pressure on rupee

2. Global Events & USD Strength

When the US economy is strong, USD becomes stronger

Oil prices going up = India paying more = rupee weakens

Wars, global tension, financial crises – all affect currency

3. RBI’s Actions

RBI sometimes buys or sells dollars to control sudden changes.

Think of RBI as a referee – it can’t play the match, but it can keep the game under control.

Historical INR to USD Exchange Rate: A Timeline (1947-Present)

Let’s look at how the rupee travelled from Independence till today.

You’ll be surprised – the journey is wild.

Before 1947 – Silver Standard

India used silver, not gold, so the rupee’s value shifted based on silver prices.

1947-1973 – Fixed Exchange Rate

In 1947, 1 USD ≈ ₹3 to ₹4 (yeah, really!)

India kept the currency fixed, not floating like today

Big devaluations happened in 1966

1973-1991 – Peg to Basket of Currencies

Rupee was controlled by govt and RBI

Still not fully market-driven

Value slowly slipped as the economy struggled

1991 Onward – Free/Floating Rate

1991 crisis → rupee was devalued

India allowed the market to decide the value

After 2000s, USD generally stayed stronger

Recent years: rupee hit multiple record lows

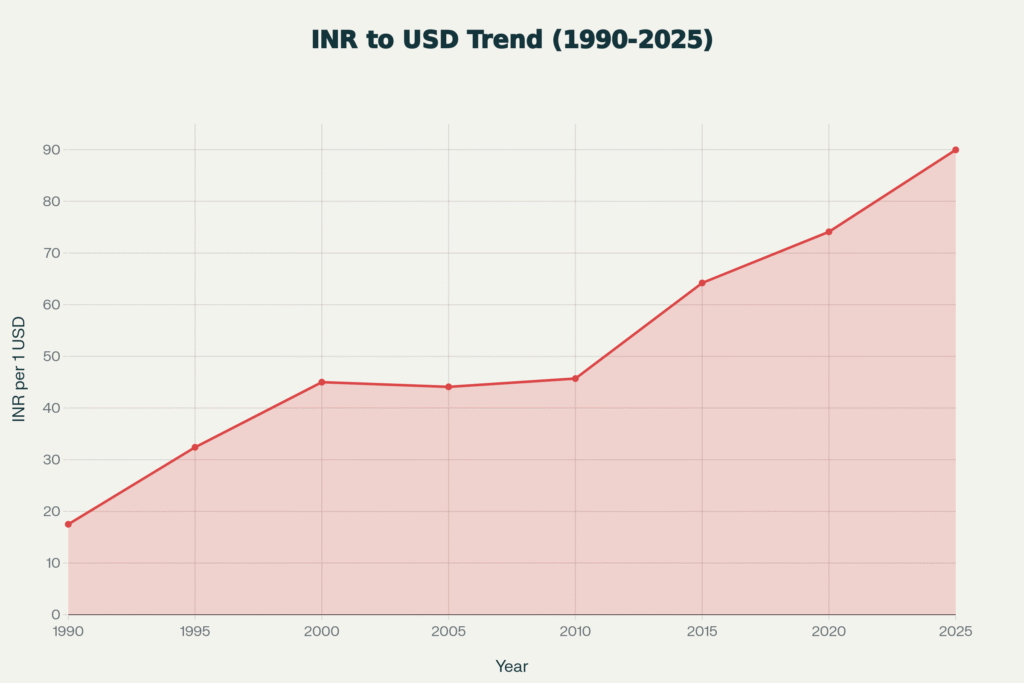

Tables or graphs can be added here to show year-by-year changes.

Graph: INR to USD Long-Term Trend

Key Moments When the Rupee Crashed or Recovered

Some major events that changed the rupee’s value:

1966 devaluation : huge drop

1991 crisis : India almost ran out of dollars

2008 financial crisis : global shock

2013 taper tantrum : foreign investors pulled money

2020 COVID crash : uncertainty, rupee weakened

2022-2024 : strong USD + high oil prices = rupee pressure

How to Convert INR to USD (Simple Guide)

If you’re travelling abroad or doing online payments, here’s the easy method:

Steps:

Check the live INR-USD rate (Google or RBI link).

Multiply your rupees by the current rate.

Compare rates from banks, forex agents, and apps – charges can differ.

Avoid last-minute airport exchanges – they loot you with fees.

Watch out for:

Hidden fees

Commission

Extra GST

Fake “zero commission” claims

Why INR-USD Movements Matter for You

A weaker rupee affects everyone, not just the government.

Travel becomes more expensive (USD rate high = costly trips)

Imported goods get expensive (phones, laptops, oil)

NRIs send more value in remittances

Businesses that import raw materials suffer

Exports become more competitive

Market Forecast: What Experts Expect for INR vs USD

Nobody can predict currency perfectly – not even experts.

But analysts say future movements depend on:

India’s inflation

RBI’s interest rates

Oil price trends

Global market stability

US Federal Reserve policies

Some predict slow depreciation; others expect stability if India’s growth stays strong.